Background:

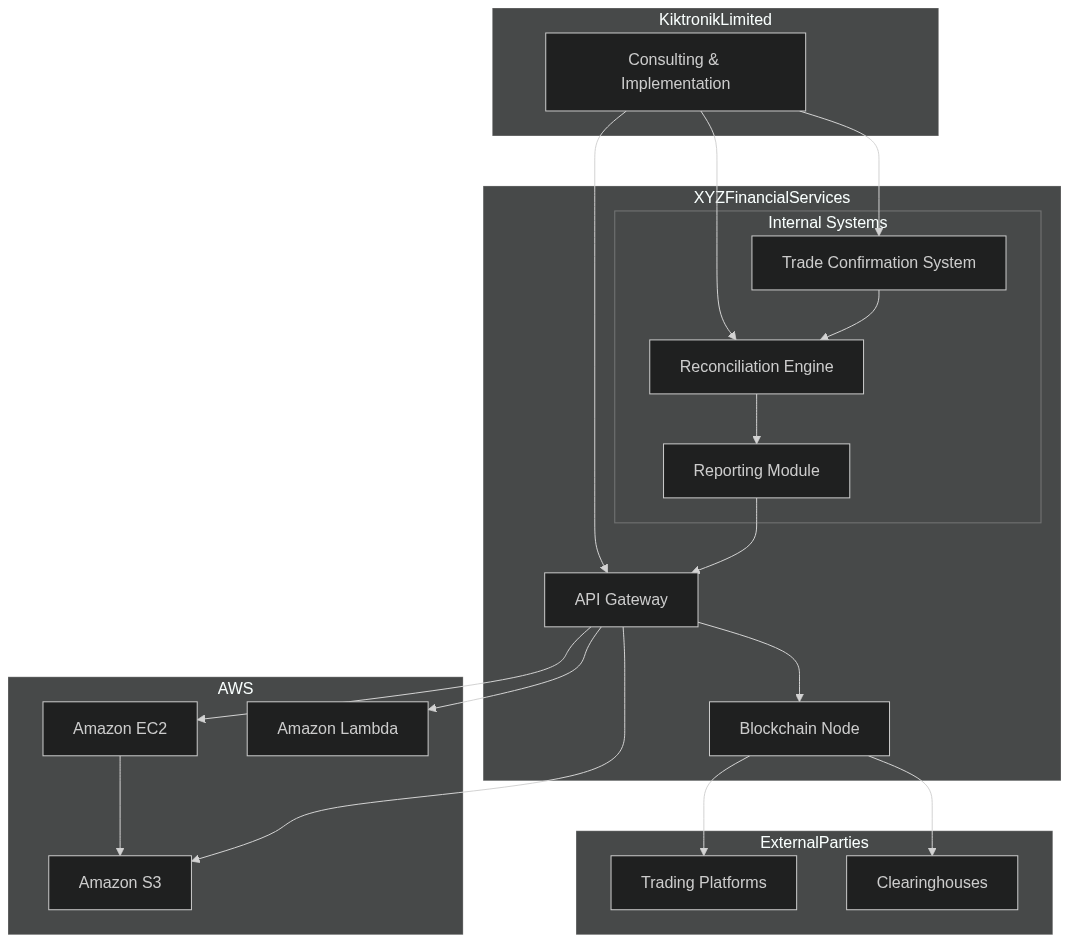

XYZ Financial Services, a leading financial institution, recognized the need to enhance its trade reconciliation process to ensure accuracy, reduce operational risks, and meet evolving regulatory requirements. The organization decided to leverage cutting-edge technologies to implement a real-time trade reconciliation system. To achieve this, XYZ Financial Services contracted Kiktronik Limited, a renowned technology consulting firm, for strategy, architecture, and implementation.

Challenges:

- Manual Processes: The existing trade reconciliation process at XYZ Financial Services relied heavily on manual intervention, leading to delays and increased susceptibility to errors.

- Scalability Issues: As the volume of trades increased, the legacy reconciliation system struggled to scale efficiently, causing delays in settlement and increasing the risk of discrepancies.

- Regulatory Compliance: Evolving regulatory requirements demanded a more agile and compliant reconciliation system. The organization needed a solution that could adapt to changing regulations seamlessly.

Solution:

1. Technology Evaluation:

Kiktronik Limited conducted a thorough evaluation of various technologies to address the specific challenges faced by XYZ Financial Services. The primary considerations were automation, scalability, security, and compliance.

2. Blockchain Technology:

Given the decentralized and tamper-resistant nature of blockchain, it was chosen to enhance the security and transparency of trade records. Blockchain would serve as a distributed ledger, allowing all parties involved in a trade to access a single source of truth, reducing the risk of discrepancies and fraud.

3. Cloud Computing (AWS):

To address scalability issues and provide a flexible infrastructure, Amazon Web Services (AWS) was chosen. The cloud-based solution would enable XYZ Financial Services to scale resources dynamically based on trade volumes, ensuring optimal performance during peak periods and reducing costs during lulls.

4. API Microservices:

To facilitate seamless communication between different systems, API microservices architecture was selected. This would enable real-time data exchange between XYZ Financial Services’ internal systems, trading platforms, clearinghouses, and other stakeholders. Microservices would enhance agility and allow for modular development and deployment.

Implementation Steps:

- Requirements Gathering: Kiktronik Limited worked closely with XYZ Financial Services to understand their specific reconciliation requirements, including data formats, trade workflows, and regulatory compliance needs.

- Blockchain Integration: A private blockchain was implemented to record and verify trade transactions. Smart contracts were employed to automate certain aspects of the reconciliation process, reducing the need for manual intervention.

- Cloud Deployment: The reconciliation system was deployed on AWS, utilizing services such as Amazon EC2 for computing power, Amazon S3 for scalable storage, and AWS Lambda for serverless computing. This allowed for on-demand resource allocation and ensured high availability.

- API Microservices Development: Microservices were developed to handle various aspects of the reconciliation process, such as trade confirmation, data validation, and discrepancy resolution. These microservices communicated through APIs, ensuring a modular and interoperable system.

- Testing and Optimization: Rigorous testing was conducted to ensure the reliability and accuracy of the real-time reconciliation system. Performance testing on AWS helped optimize resource utilization, ensuring efficiency during peak trading periods.

- Training and Deployment: XYZ Financial Services staff were trained on the new system, and the solution was gradually rolled out to minimize disruptions to ongoing operations.

Results:

- Real-Time Reconciliation: The implementation of blockchain, cloud, and API microservices enabled XYZ Financial Services to achieve real-time reconciliation, reducing settlement times and minimizing the risk of errors.

- Scalability: The cloud-based solution provided by AWS allowed XYZ Financial Services to scale resources dynamically, ensuring optimal performance even during periods of high trade volume.

- Security and Transparency: The blockchain-based ledger enhanced the security and transparency of trade records, reducing the risk of discrepancies and fraud.

- Regulatory Compliance: The agile architecture of the system facilitated quick adaptation to changing regulatory requirements, ensuring that XYZ Financial Services remained compliant with industry regulations.

- Operational Efficiency: Automation and the use of microservices streamlined the reconciliation process, reducing the need for manual intervention and improving overall operational efficiency.

Conclusion:

By partnering with Kiktronik Limited and strategically leveraging blockchain, AWS, and API microservices, XYZ Financial Services successfully implemented a real-time trade reconciliation system that addressed their specific challenges. The new system not only enhanced operational efficiency but also positioned the organization to adapt to future changes in the financial landscape. This case study highlights the importance of adopting innovative technologies to transform traditional financial processes and stay competitive in a rapidly evolving industry.